Who needs corporate travel insurance?

If you or your employees need to travel for work, Corporate Travel Insurance can protect your business from financial loss associated with situations such as overseas health emergencies, flight cancellations or lost and stolen baggage. While Business Insurance covers major assets of your operations, public liability, expenses and interruption, corporate travel insurance will offset the risk of unpredictable events while travelling for work purposes.

Corporate Travel Insurance is similar to personal travel insurance. It can cover your business for unanticipated travel costs if specific events happen.

Corporate Travel Insurance also covers your directors and employees and spouses and dependants travelling with them.

Not sure whether you need it or not?

TALK TO AN ADVISOR“All travel carries with it inherent risks, even short-term travel to familiar overseas locations for meetings or conferences. Risks from political tensions, civil unrest, fraud, severe weather, natural disasters and security of corporate information exist in countries that are not usually considered dangerous.”

Smart Traveller website, 2017

Did you know?

31% of Australians have travelled overseas in the past three years without travel insurance

(DFAT, Survey of Australian’s Travel Insurance Behaviour, August 2016)

For frequent travellers, annual travel insurance cover is significantly cheaper than taking out cover for one-off trips

(Compare Travel Insurance, Annual Travel Insurance Guide, 2016)

24% of all travellers experienced a loss on their most recent overseas trip that would be covered by most travel insurance policies

(DFAT, Survey of Australian’s Travel Insurance Behaviour, August 2016)

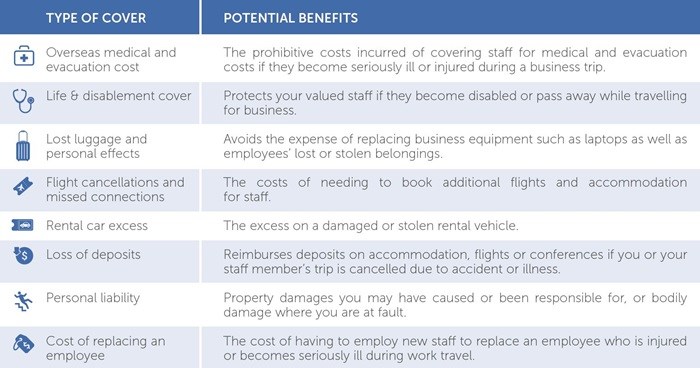

Corporate Travel Insurance policies vary in the benefits they provide.

Your Westlawn Insurance Broker can help you find the right product to suit your business travel needs.

Here are the types of cover that your policy may include:

Exclusions and the excess you need to pay can vary greatly depending on your insurer. However, exclusions may include:

- Some pre-existing conditions (your broker can explain these)

- Refunds if your travel provider becomes insolvent

- Pregnancy

- Travelling against medical advice.

There are other exclusions which your Westlawn Insurance Broker can outline for you.

Case study – Corporate Travel Insurance

While visiting clients in London, your employee falls down a flight of stairs, fracturing their hip and breaking their arm. After being taken to hospital in an ambulance, doctors take x-rays and MRIs of the injured areas. Your employee is informed that they require surgery on their hip and will have to undergo physiotherapy before they will be allowed to fly home to Australia. Their flight is scheduled for the following day but will now need to be cancelled.

A Corporate Travel Insurance policy allows you to recover some or all of these costs. Depending on the policy, you may be able to claim for the medical costs of their surgery and rehabilitation ,as well as the flight cancellation and additional accommodation required while your employee undergoes physiotherapy. You may also be able to claim for the hire of someone to to take over your employee’s duties until they are back in Australia and fit to return to work.

What are you waiting for? …

Speak to an expert today

Call us today 1300 937 852

or leave your details with us and we’ll give you a call.